R&D tax credits can be a much-needed source of non-diluting capital for companies, particularly those still in the early stages of growth. In Ireland, any research and development activities that successfully qualify as ‘R&D’ can earn you a 25% refund of the cost incurred as tax credits. The detailed guidelines for filling out your own tax claim can be accessed on Revenue.ie for those who wish to take the DIY approach. However, it can be a fraught process, with some of the wording in the Revenue guidelines intentionally vague. For the inexperienced, there are a lot of challenges involved in filing your own R&D tax claims, and it’s crucial that you take these into account before attempting to do so.

When reading below, keep in mind the following: a company’s Founder / CTO and their internal finance team will likely prepare one R&D return a year. Conversely, R&D specialists such as ProfitPal prepare 30+ claims a year. Understanding the technical pitfalls and tax landmines, and being able to benchmark a claim to literally hundreds of others, holds significant advantages in maximising an eligible claim and dealing with Revenue when inevitable queries arise.

- Our fees are not due until you receive your R&D refunds in your bank account

- We’re experts in R&D (tax and tech) who prepare detailed scientific and accounting packs to support your claim

- We deal with revenue queries, current and future

- We’ve done this a lot, so we know what to claim and what not to claim for. Don’t maximise your claim. Maximise your eligible claim.

- Investors looking at your business and carrying out due diligence will not want to see DIY claims.

For the small company set on filing their own R&D tax claims, read on for the main challenges you will likely encounter…

#1. Discerning what is eligible R&D

This is likely the primary challenge for any CTO / Founder / Internal Finance staff in submitting R&D tax claims, especially if your company is in the field of software development. In their latest iteration of the R&D Tax Credit Guidelines, Revenue has outlined a very specific definition of what qualifies as viable research and development for the purpose of claiming tax credits. More generally, a project must ‘seek to achieve scientific or technological advancement’ while involving ‘the resolution of scientific or technological uncertainty’.

The definition of qualifying software development R&D is narrower still. According to the guidelines, most software development uses pre-existing tools and methodologies, and takes place in standard development environments. As such, they do not seek to resolve ‘technological uncertainty’. Activities such as routine analysis, copying, upgrading, or adapting an existing product or process thus don’t qualify as R&D activity.

Moreover, claimants might have a mix of qualifying and non-qualifying R&D activity. They will have to separate qualifying and non-qualifying R&D for their claim. And on top of all this, claimants must identify not only the scientific or technological developments resulting from their work, but the phases of the software development life cycle that qualify for their tax credit claim. It can be a daunting process, and if you have any uncertainty as to what activity you can claim for, you are better off hiring a tax and technical professional to handle your claim.

#2 Which expenditures qualify for R&D tax credits?

Once you have ascertained which activities qualify for your claim, you then will have to further narrow down which expenditures from these activities are viable. Qualifying expenditures need to be incurred in ‘the carrying out’ of qualifying activity. So that rules out administrative expenditures such as:

- shipping

- maintenance

- utilities

- travel to carry out R&D, rent and so on.

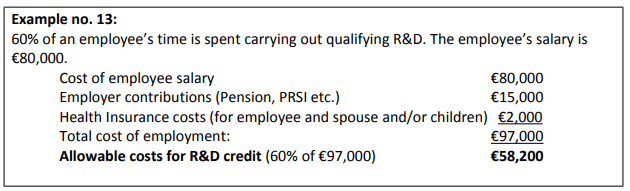

With regards to staff salaries, if an employee has multiple roles, you will need to determine what percentage of their time goes towards qualified R&D activities. You can factor in the costs of pensions, health insurance, and other bonuses into this equation.

For example:

Keep in mind, any individual included in the R&D claim must be capable of being directly linked back to the technical development efforts and the R&D projects.

#3 Changes in Revenue guidelines may further obfuscate your claims process

It’s crucial that when preparing your tax claim you are filling in the most up-to-date forms, and adhering to the latest guidelines. However, Revenue can update their requirements on a yearly basis, with little to no warning for those who aren’t expecting it. Especially when it comes to the tech industry, while the legislation remains largely unchanged, Revenue’s definitions and qualifications have shifted over a number of years. Since January 2019, Revenue have amended their guidelines 4 times, with over 30 alterations in different parts of the document.

#4 Knowing what amount of subcontracted R&D activity is claimable

Another challenge in filing your own R&D claims is factoring in subcontracted activity. There are only two situations in which a company can claim R&D tax credits when they have not been the entity to directly complete the activities being claimed for.

- When a company incurs expenses by subcontracting their R&D activities to a university or other higher education institution

- When a company incurs expenses by subcontracting their R&D activities to a third-party which is not a ‘connected person’, i.e. not a person who can exert control over the company

Revenue applies thresholds to the subcontracted activity. The amount is either a percentage of the overall R&D expenditure or 100,000 euros, whichever is higher. This is provided the outsourced expenditure is at least matched by internal R&D expenditure.

#5 Coming to terms with the opportunity cost of filing your own claim

Filing R&D tax claims can be a frustrating and time-consuming process, rife with challenges. In addition to those listed above, there are many other problematic aspects to submitting a claim. It can take weeks or even months for an inexperienced company to file their own claim to the degree that they are confident they have been completely accurate, and are at minimum risk of audit.

And even so, there remain challenges and pitfalls. The more you immerse yourself in the minutiae of submitting an accurate tax claim, the less attention you will be able to devote to other areas of running your business. What’s more, if your claim is selected for an audit you will have to go through the process on your own.

With ProfitPal, you can be confident that your R&D claims are in the hands of experienced professionals. Our accounting and technical team have 8 years of securing tax refunds for start-ups and SMEs in Ireland. Every member of our team is highly qualified and fully committed to securing for our clients the maximum tax credits they are entitled to. We have had a 100% success rate thus far. Our R&D claims returning over 20 million euros to our clients’ businesses. What’s more, if Revenue happens to select your claim for an audit, we will give you full support and guidance until the audit is resolved.

For more information on claiming R&D tax credits for software development, read our blog post here.

If you have questions about preparing and submitting your R&D tax credit claim, or you would like to know more about how ProfitPal can help you maximize your refund, we would love for you to get in touch with us.